Using the Tax Code to Your Advantage

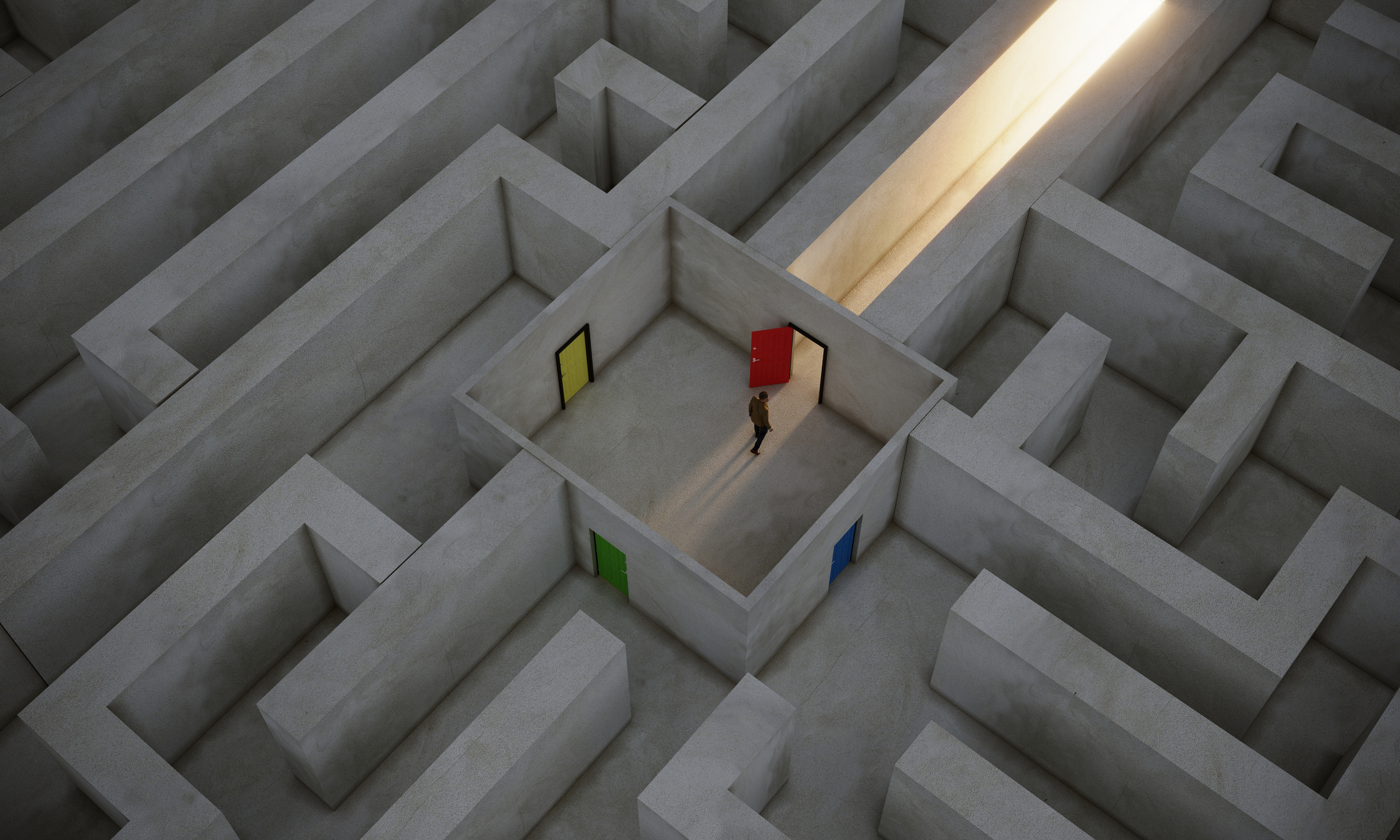

Congress has enacted laws over time to stimulate economic activity, reducing or even eliminating income and capital gains taxes depending on the circumstance. However, these opportunities often remain hidden within the intricate tax code. When strategically harnessed, they can significantly reduce tax burdens.

Our boutique firm leverages cutting-edge technology and extensive experience to discover, validate, and implement strategies that leverage these obscured opportunities in the tax code. We tailor robust solutions to your historical, present, or future tax scenarios and streamline the analysis and implementation process, enabling our partners and clients to maximize their financial bottom-line.